Japanese cryptocurrency exchange DMM Bitcoin announced its decision to shut down operations following a severe security breach in May that resulted in more than $300 million in losses.

The latest report states that the exchange has agreed to transfer its assets to SBI VC Trade, the crypto division of Japan's financial conglomerate SBI Group.

Key Details Revealed

The planned closure follows a tumultuous period for DMM Bitcoin, which suffered the theft of 4,502.9 BTC, valued at approximately $306 million at the time of the hack.

In response to the breach, the company secured funding amounting to 55 billion yen ($365.1 million) through a combination of loans and capital increases to address the financial shortfall.

Despite these efforts, the exchange has opted to cease operations and transfer its customer accounts and custodial assets to SBI VC Trade by March 2025.

According to a statement released by DMM Bitcoin, the asset transfer agreement with SBI VC Trade excludes open positions in leveraged trading. Customers are required to settle all leveraged trading positions before the transfer is finalized.

This measure, according to the report, ensures a “smoother transition” of custodial assets to SBI VC Trade, which is set to expand its offerings by handling spot trading for 14 cryptocurrencies currently available on DMM Bitcoin's platform.

Notably, the asset acquisition by SBI VC Trade is part of the company's strategy to strengthen its presence in Japan's cryptocurrency market. This move also aligns with SBI's larger ambitions in the digital asset sector, which include partnerships and expansions in blockchain technology and decentralized finance.

Japan Crypto Stance

Notably, the recent decision by crypto exchange DMM Bitcoin coincides with Japan's cautious stance toward the cryptocurrency industry.

Japan's Financial Services Agency (FSA) official recently announced plans for a comprehensive review of the country's crypto regulations in the coming months.

The primary aim is to assess whether the current framework under the Payments Act sufficiently addresses the complexities of digital asset management.

If changes arise from this review, they could signal a major regulatory shift. One potential outcome is reducing tax rates on crypto gains—from the current 55% to 20%—bringing them in line with taxes on assets like stocks and other financial instruments.

Despite regulatory uncertainties, a recent survey by Nomura Holdings and Laser Digital Holdings highlights growing investor interest in the crypto market in Japan.

The survey, which polled 547 investment managers from sectors such as family offices and public interest corporations, revealed that 54% plan to enter the digital currency space within three years.

While only 16% see digital currencies as viable replacements for traditional currencies, 62% regard them as lucrative investment opportunities with high returns.

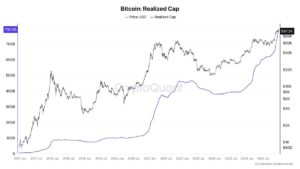

Featured image created with DALL-E, Chart from TradingView