An analyst broke down the strategy behind the aggressive Bitcoin acquisition being done by MicroStrategy which is gaining attention because of the rising price of the alpha crypto.

Anthony Pompliano, Founder & CEO of Professional Capital Management, understood the mathematical reason behind the company's investment move but also warned that any investment is exposed to potential risks.

MicroStrategy's Bitcoin Acquisition

Pompliano said that MicroStrategy is making a bold move to buy more Bitcoin and build up its crypto reserve by using convertible debt to finance the cryptocurrency's acquisition.

The investment firm offers its shares at a higher price than the current price per share to generate funds for its Bitcoin acquisition.

Pompliano explained that MicroStrategy is selling future equity at a 55% premium to help the company buy more Bitcoin, saying that is a financially attractive move, saying, “This strategy makes sense from a financial perspective.”

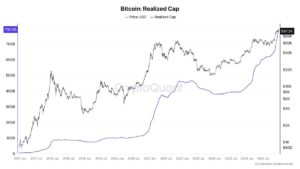

Image: Crypto Economy

The analyst said that it is a beneficial strategy for MicroStrategy because it allows the investment firm to gain significant capital which the company is now using to buy a lot of the leading crypto, saying that this approach makes sense mathematically.

The Bitcoin Investment Plan

In October this year, MicroStrategy announced that it would be conducting a Bitcoin shopping spree by raising $42 billion in new capital in the next three years to finance its goal of buying more BTC.

Some analysts consider this Bitcoin investment strategy as a bold move being eyed by the investment firm.

Bitcoin market cap currently at $1.92 trillion. Chart: TradingView.com

According to the company's executive, the objective of MicroStrategy's capital-raising approach is to obtain $21 billion in fresh capital from equity offerings and generate another $21 billion from fixed-income securities between 2025 and 2027.

As of September 2024, MicroStrategy is already the largest Bitcoin holders among the publicly traded companies worldwide. Buying more of the crypto would further boost its position at the top spot among public companies.

Image: Theya Blog

Associated Risks

Pompliano understood the appeal of the Bitcoin proposition, saying that the move could be lucrative for the investment company.

However, the analyst pointed out that investors must not overlook the risks associated with such investments, saying anyone who wants to embrace MicroStrategy's approach should understand the risks before dipping their feet into it.

“Now, the counterweight to that is there's a hell of a lot of people I see saying nothing can go wrong. I’m not in that camp,” he said.

Pompliano explained that the investment firm's strategy is not foolproof, saying that some people assumed that nothing could derail the investment plan.

“I couldn't sit here and tell you what can go wrong, but what I can tell you is that an alarm goes off in my head when I start seeing everyone saying nothing can go wrong,” he expressed.

He pointed out there are volatility risks when people invest in Bitcoin, adding that the uncertain regulatory environment could amplify the risks associated with the aggressive purchasing of BTC.

Featured image from Canva, chart from TradingView