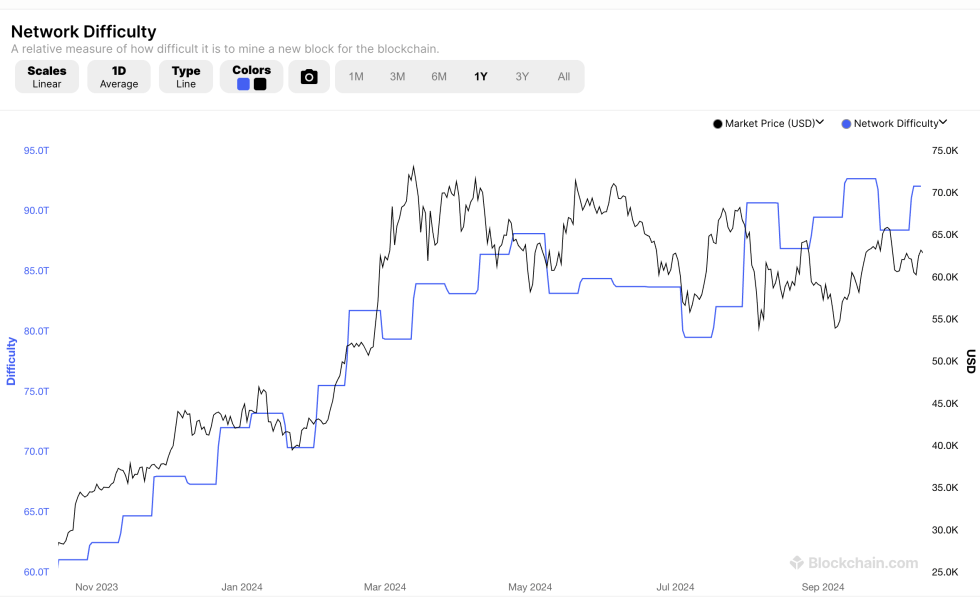

According to a recent report by Jefferies, Bitcoin (BTC) mining profitability declined in September while the network hashrate continued to surge.

Bitcoin Mining Profitability On A Downtrend

In a report published on Sunday, investment bank Jefferies outlined that Bitcoin mining profitability plummeted in September compared to August. Specifically, the daily revenue per exahash fell by 2.6% month-over-month (MoM).

For the uninitiated, daily revenue per exahash refers to the amount of BTC that miners earn for each exahash – 1 quintillion hashes – of computational power they contribute to the network daily.

The metric helps measure the profitability of mining operations by showing how much revenue miners generate based on the collective power they dedicate to solving Bitcoin's cryptographic challenges.

During the same period, while the average BTC price remained stagnant, its network hashrate surged by 1.7%, indicating that more computational power is being dedicated to securing the network, making it more resilient to attacks. However, rising hashrate also trims miners' profit margins due to increased mining activity and competition.

Notably, North America-based Bitcoin mining firms increased their share of total BTC production, rising from 19.9% in August to 22.2% in September. The report attributes the increase to better uptime from these companies due to lower overall temperatures.

Among the Bitcoin mining firms, Marathon Digital mined 705 BTC, followed by CleanSpark, which mined 403 BTC. Marathon also leads the industry with the highest hashrate at 36.9 exahashes per second (EH/s) as of September 30, 2024. Riot Platforms follows closely with 28.2 EH/s.

Although Chinese mining pools still control most BTC hashrate, US-based mining pools are rapidly catching up. As of September 23, China and the US collectively controlled 95% of all Bitcoin hashrate, casting serious concerns about the network's decentralization narrative.

October is Poised To Be A Challenging Month

In the report, Jefferies posited that October could likely be a tougher month for the BTC mining sector. The report reads:

October is currently poised to be a harder month with BTC prices only up around 5%, while the network hashrate up +11% more than offsets that growth.

In April 2024, Bitcoin underwent its fourth halving that effectively slashed mining rewards by half, from 6,250 BTC to 3,125 BTC. According to analysts, the halving is expected to lead to annual revenue loss to businesses worth over $10 billion.

The report concludes that regardless of who wins the upcoming US presidential elections in November, there are chances of witnessing “incrementally favorable policies toward the industry.”

In contrast, another US-based investment firm Bernstein opines that a win for Republican candidate Donald Trump could propel BTC price to new all-time highs (ATH). At the same time, the market requires a clearer stance from the Democratic candidate Kamala Harris. BTC trades at $65,073 at press time, up 4.0% in the last 24 hours.

Featured Image from Unsplash.com, Charts from Blockchain.com and TradingView.com